Challenges & The Solution:

Our client, a large banking institution, faced hurdles due to reliance on their core software provider for services. The process took too long, hindering competitiveness. Our client knew they needed to make changes, and fast, to be able to keep up with the competition. They adopted Profound API, streamlining their operations.

The Issue:

The bank’s dependency on its external software vendor led to exorbitant costs and significant release delays. For each requested change, our client had to wait anywhere from 4-8 weeks for the changes to come to fruition. And each request came at a lofty cost, as the vendor charged for each change assignment. The lengthy time of release and additional professional services rates put our client at a disadvantage, allowing their competition to get ahead.

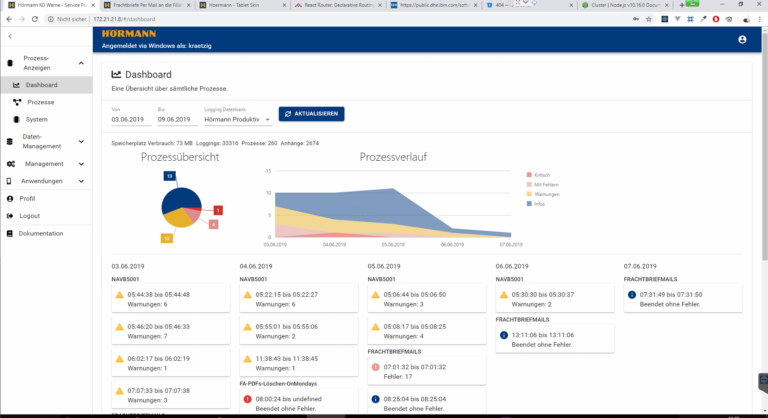

Revolutionary Impact of Profound API:

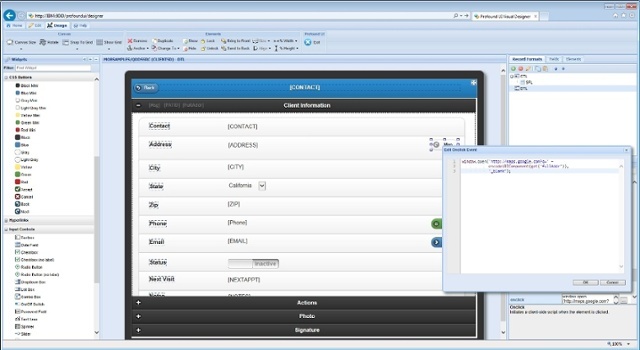

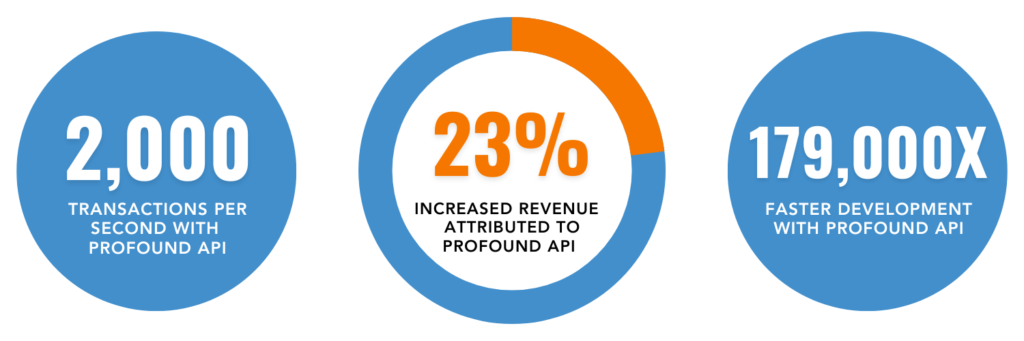

Profound API proved pivotal, revolutionizing key operational areas. It drastically cut service development time from 8 weeks to just 45 minutes. This agility allowed our client to boost customer responsiveness, innovation, and market presence. Profound API’s processing prowess allowed our client to process 2,000 transactions/sec, giving them an edge over their competitors. Efficiency gains translated to a competitive edge, seizing lost opportunities. Costs were optimized via reduced development expenses . These savings empowered strategic resource allocation, fueling growth. Profound API’s adaptability amplified innovation, enabling rapid service rollout.

Independence & Revenues:

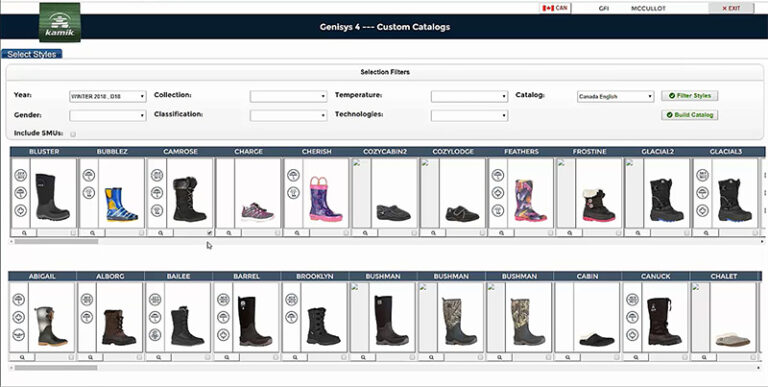

With Profound API, vendor dependency ended. Autonomy enabled customization, iteration, and tailored services. Tangibly, client revenues increased by 23%, attributed to the adoption of Profound API. This solid outcome underscored operational streamlining and direct financial impact.

The Industry Context

Banking faces intricate IT issues due to critical operations and dynamic tech. Challenges include legacy systems’ integration hurdles, stringent security demands, data management complexities, digital shift, fintech competition, shifting regulations, scalability needs, vendor management intricacies, meeting high customer expectations, and IT talent scarcity.

Elevating Your Business:

Ready for transformative strides? Make our client’s journey your own, explore our solutions or connect with us at sales@profoundlogic.com.